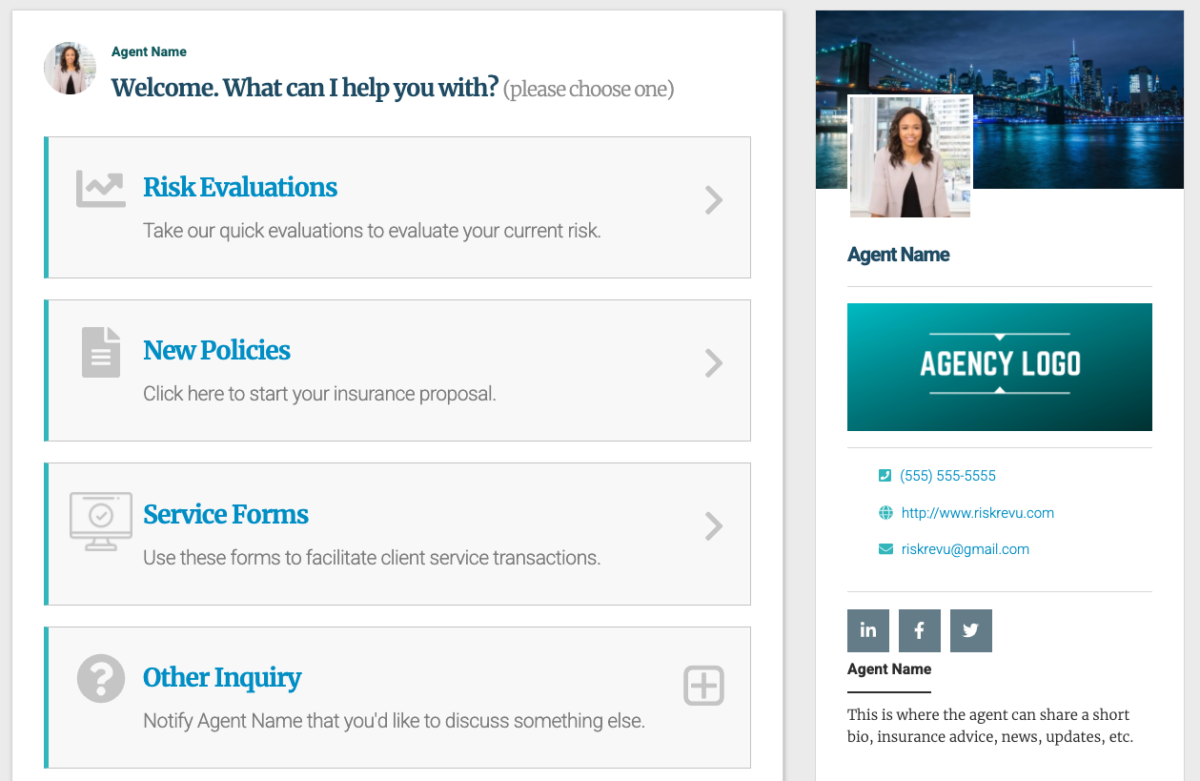

RiskRevu SmartForms Overview

The following is a list of the forms currently available with a RiskRevu account. Our digital forms library is continuing to expand. Check back frequently for updates to the list. These forms can be sent to clients or used as a guide during a phone conversation.

RISK EVALUATIONS:

- Annual Personal Risk Evaluation – This form allows a client to build their own renewal questionnaire. They can choose to complete questions from 6 different sections including: Home, Second Home, Valuable Articles, Automobile, Liability and Life Events.

- Annual Personal Risk Evaluation – Multiple Homes – This form is the same as the Annual Personal Risk Evaluation, but can collect data for up to five homes.

- Annual Personal Risk Evaluation + Life – This form is the same as the Annual Personal Risk Evaluation, but also includes questions about life insurance.

- Automobile Evaluation – Clients may just want to review their automobile insurance or that is all they have insurance for. This form is a renewal questionnaire that will ask pertinent questions about their automobile insurance.

- Business Risk Evaluation – This form gathers information about risk exposures a business has with respect to general operations, real property, commercial automobiles, staffing, as well as obtain coverage preferences from a client. This form was designed to be used as part of the commercial insurance renewal process.

- Condominium/Cooperative Evaluation – Clients may just want to review their Condominium / Cooperative insurance or that is all they have insurance for. This form is a renewal questionnaire that will ask pertinent questions about their condominium / cooperative.

- Cyber Risk Renewal Questionnaire – This form is used for commercial clients at renewal to identify the cyber risk management practices they have in place.

- Excess Flood Renewal List Evaluation – This form help conduct an analysis between expiring and renewal excess flood policies.

- Flood Risk Evaluation – Send this form to clients to help them evaluate their risk of flooding at home and verify several rating factors for a personal flood insurance policy.

- Golf Cart Risk Evaluation – This form is designed to determine the usage of a golf cart and how it should be insured.

- High-Value Home Coverage and Risk Evaluation (Premium Form) – This form asks a series of questions about high-value home insurance and provides answers depending on how the questions are answered. This form can be used for digital marketing purposes.

- Homeowners Evaluation – Clients may just want to review their home insurance or that is all they have insurance for. This form is a renewal questionnaire that will ask pertinent questions about their home.

- Personal Insurance Change of Address Request Form – Send this form to a client to obtain new address information.

- Personal Insurance Moving Risk Evaluation – Send this form to a client to obtain information about a move from one residence to another. It will help identify exposures during transit that need attention.

- Personal Liability Evaluation – Clients may just want to review their liability insurance. This form is a renewal questionnaire that will ask pertinent questions about their liability exposures.

- Residential Automatic Water Shut Off Valve Evaluation – Use this form to obtain information about a residence’s plumbing system to assist with the recommendation of an automatic water shut off valve.

- Residential Replacement Cost Evaluation – Use this form to gather information to help calculate the replacement cost of a client’s home.

- Residential Wood Burning Stove Evaluation – This form is used to gather information on how a wood burning stove is installed to ensure compliance with carrier guidelines.

- Technology Professional Liability Renewal Questionnaire – This form is designed to gather information required at renewal for Technology Professional Liability policies.

- Valuable Articles Evaluation – Clients may just want to review their valuable articles insurance or that is all they have insurance for. This form is a renewal questionnaire that will ask pertinent questions about their valuable articles.

- Valuable Collections Risk Evaluation – Share this form with a client to gather detailed information about their jewelry and art collections. It will help identify exposures to risk and risk management techniques that could be utilized.

- Watercraft Hurricane Preparedness Plan Risk Evaluation – Share this form with a client to gather information about the hurricane preparedness plan for their watercraft.

- Wine Collection Risk Evaluation – This form gathers information about a wine collection to better understand the risk involved with it.

NEW POLICY FORMS:

- Aircraft Insurance Form – Collect information needed to obtain a quote for Aircraft Insurance for your clients.

- Aircraft Pilot Form – This form will gather pilot experience information needed to quote new aircraft insurance or to add a pilot to an existing policy.

- All Terrain Vehicle/ATV Insurance – Current Client Form – Collect information needed to obtain a quote for ATV insurance for a current client.

- All Terrain Vehicle/ATV Insurance – Collect information needed to obtain a quote for ATV insurance for your clients.

- Apartment Building Form – Collect information needed to obtain a quote for a multi-family commercial apartment building.

- Automobile Insurance Form – Collect information needed to obtain a quote for Automobile insurance for your clients.

- Automobile Insurance Form – Current Client – Collect information needed to obtain a quote for Automobile insurance for a current client.

- Builders Risk – New Construction Insurance Form – Collect information needed for a commercial Builders Risk.

- Business Cyber Liability Form – Collect information needed to obtain a quote for Business Cyber Liability insurance for your clients.

- Business Owners Insurance Form – Collect information needed to obtain a quote for Business Owners insurance for your clients.

- Collector Car Insurance Form – Collect information needed to obtain a quote for Collector Car Insurance for your clients.

- Collector Car Insurance Form – Current Client – Collect information needed to obtain a quote for Collector Car Insurance for current clients.

- Collector Car Insurance Form – Expanded – Collect information needed to obtain a quote for up to six collector vehicles.

- Commercial Errors & Omissions Form – This form gathers information for commercial errors & omissions exposures.

- Commercial Errors & Omissions Form – Expanded – This form gathers detailed information for commercial errors & omissions exposures.

- Commercial Insurance Basic Form – This form collects general details of a business’s insurance needs.

- Commercial Product Liability Insurance – Collect information to obtain a quote for Commercial Product Liability including foreign manufactures supplemental questions.

- Condominium/Cooperative Insurance – Florida Form – Collect information needed to obtain a quote for Condominium/Cooperative insurance for a client in Florida.

- Condominium/Cooperative Insurance Form – Collect information needed to obtain a quote for Condominium/Cooperative insurance for your clients.

- Condominium/Cooperative Insurance Form – Current Client – Collect information needed to obtain a quote for Condominium/Cooperative insurance for current clients.

- Condominium/Cooperative Insurance Form – Current Client/Florida – Collect information needed to obtain a quote for Condominium/Cooperative insurance for current clients in Florida.

- Construction/Renovation Insurance Expanded Form – Collect information about a renovation or new construction project and chose a high-net-worth carrier to have their respective supplemental form automatically populated.

- Contractors Insurance Form – Collect information needed to obtain a quote for Contractors Insurance.

- Farm Package Policy Form – Collect information needed to obtain a quote for Farm Insurance.

- Group Personal Excess Liability – Employment Practices Request Form – Collect information needed to complete an employment practices liability questionnaire as part of a group excess policy.

- Group Personal Excess Liability – High Limit Request Form – Collect information needed to complete a high limit questionnaire as part of a group excess policy.

- Group Personal Excess Liability Uninsured/Underinsured Motorist Protection Rejection/Selection Form – Streamline the completion of the uninsured/underinsured motorist form for Chubb group excess renewals.

- Group Health Insurance Form – Collect information needed to obtain a quote for Group Health insurance for your clients.

- Health Insurance Form – Collect information needed to obtain a quote for Health insurance for your clients.

- High Hazard Flood Zone Insurance Form – Collect information needed to obtain a quote for High Hazard Flood Zone insurance for your clients.

- Homeowners Insurance Basic Form – Collect basic information needed to obtain a quote for Homeowners insurance for your clients.

- Homeowners Insurance California Form – Collect information needed to obtain a quote for Homeowners insurance for a home in California.

- Homeowners Insurance California Form – Current Client – Collect information needed to obtain a quote for Homeowners insurance for a current client’s home in California.

- Homeowners Insurance Coastal Form – Collect information needed to obtain a quote for Homeowners insurance for a coastal home.

- Homeowners Insurance Comprehensive Form – Collect detailed information needed to obtain a quote for Homeowners insurance for your clients.

- Homeowners Insurance Current Client Form – Collect information needed to obtain a quote for Homeowners insurance for a current client

- Homeowners Insurance Florida Form – Collect information needed to obtain a quote for Homeowners insurance for a home in Florida.

- Homeowners Insurance Florida Form – Current Client – Collect information needed to obtain a quote for Homeowners insurance for a current client’s home in Florida.

- Individual Life Insurance Form – Collect information needed to obtain a quote for Life insurance for your clients.

- Motorcycle Insurance Form – Collect information needed to obtain a quote for Motorcycle insurance for your clients.

- Motorcycle Insurance Form – Current Client – Collect information needed to obtain a quote for Motorcycle insurance for current clients.

- Not-For-Profit Organization Professional Lines Package Form – Use this form to collect detailed information for a Not-For-Profit organization you want to provide a proposal for.

- Personal Excess Liability/Umbrella Insurance Form – Collect information needed to obtain a quote for Umbrella insurance for your clients.

- Personal Insurance Package Policy Form – This is a comprehensive form that can collect information needed to quote all or any of the following lines of business all in the same form. Home, Condominium/Cooperative, Renters, Valuable Articles, Automobile, and Excess Liability.

- Personal Insurance Package Expanded Form – Multiple Homes (5) + Life – This is a comprehensive form that can collect information needed to quote all or any of the following lines of business all in the same form. Up to five Homes, Condominium/Cooperative, Renters, Valuable Articles, Automobile, Excess Liability and Life.

- Personal Insurance Package Policy – Florida Form – This is a comprehensive form that can collect information needed to quote all or any of the following lines of business (in Florida) all in the same form. Home, Condominium/Cooperative, Renters, Valuable Articles, Automobile, and Excess Liability.

- Personal Insurance Package Policy Form + Life – This is a comprehensive form that can collect information needed to quote all or any of the following lines of business all in the same form. Home, Condominium/Cooperative, Renters, Valuable Articles, Automobile, Excess Liability and Life.

- Personal Insurance Package Policy – California Form – This is a comprehensive form that can collect information needed to quote all or any of the following lines of business (in California) all in the same form. Home, Condominium/Cooperative, Renters, Valuable Articles, Automobile, and Excess Liability.

- Personal Insurance Package Policy – California Form – Multiple Homes – This is a comprehensive form that can collect information needed to quote all or any of the following lines of business (in California) all in the same form. Up to three Homes, Condominium/Cooperative, Renters, Valuable Articles, Automobile, and Excess Liability.

- Personal Insurance Package Policy – Expanded Form – This is a comprehensive form that can collect information needed to quote all or any of the following lines of business all in the same form. Two Homes, Condominium/Cooperative, Renters, Valuable Articles, Automobile, Collector Car, Watercraft and Excess Liability.

- Personal Insurance Package Policy – Multiple Homes – This is a comprehensive form that can collect information needed to quote all or any of the following lines of business all in the same form. Up to three Homes, Condominium/Cooperative, Renters, Valuable Articles, Automobile, and Excess Liability.

- Personal Insurance Package Policy – Multiple Homes +Life – This is a comprehensive form that can collect information needed to quote all or any of the following lines of business all in the same form. Up to three Homes, Condominium/Cooperative, Renters, Valuable Articles, Automobile, Excess Liability and Life.

- Personal Kidnap and Ransom Insurance Form – Collect information needed to obtain a quote for Kidnap and Ransom insurance for your clients.

- Personal Watercraft Insurance Form – Collect information needed to obtain a quote for Watercraft insurance for your clients.

- Personal Watercraft Insurance – Current Client Form – Collect information needed to obtain a quote for Watercraft insurance for a current client.

- Preferred Flood Insurance Form – Collect information needed to obtain a quote for Preferred Flood insurance for your clients.

- Professional Lines Package Form – Collect information needed to obtain a quote for professional lines of insurance for your clients.

- Renters Insurance Form -Collect information needed to obtain a quote for Renters insurance for your clients.

- Renters Insurance – Current Client Form -Collect information needed to obtain a quote for Renters insurance for your current clients.

- Residential Construction/Renovation Insurance Form – Collect information needed to obtain a quote for Residential Construction/Renovation Insurance for your clients.

- Residential Construction/Renovation Insurance – Current Client Form – Collect information needed to obtain a quote for Residential Construction/Renovation Insurance for your current clients.

- Residential Flood Insurance Form – Risk 2.0 – Collect information needed to obtain a quote for flood insurance for your clients.

- Residential Flood Insurance Risk 2.0 – Current Client Form – Collect information needed to obtain a quote for flood insurance for your current clients.

- Restaurant and Bar Insurance Package Form – Collect information needed to obtain a quote for restaurant and/or bar insurance for your clients.

- RV/Motorhome/Travel Trailer Insurance Form – Collect information needed to obtain a quote for RV/Motorhome/Travel Trailer insurance for your clients.

- Snowmobile Insurance – Current Client Form – Collect information needed to obtain a quote for snowmobile insurance for a current client.

- Snowmobile Insurance Form – Collect information needed to obtain a quote for snowmobile insurance for your clients.

- Special Event Insurance Form – Collect information needed to obtain a quote for special event insurance for your clients.

- Surety Bond Form – Collect information needed to obtain a quote for a surety bond for your clients.

- Travel Insurance Form – Collect information needed to obtain a quote for Travel/Trip Cancellation insurance for your clients.

- Valuable Articles Insurance Form – Collect information needed to obtain a quote for Valuable Articles insurance for your clients.

- Workers’ Compensation Insurance Form – Collect information needed to obtain a quote for Workers’ Compensation for your clients.

- Workers’ Compensation Insurance Form – Multiple States – Collect information needed to obtain a quote for Workers’ Compensation if employees are working in multiple states.

- Yacht Insurance – Current Client Form – Collect information needed to obtain a quote for yacht insurance for a current client.

- Yacht Insurance Form – Collect information needed to obtain a quote for yacht insurance for your clients.

SERVICE FORMS:

- Agent/Broker Change – Authorization Form (BOR) – Collect information needed to create a Broker of Record letter.

- Automobile Insurance Card Request Form – This form can be sent to a client who is requesting to receive an automobile insurance card for their personal or commercial policy.

- Boating Resume of Experience – This form collects boating experience information about a watercraft operator.

- Builders Risk Extension Questionnaire – This form gathers updated risk information about an ongoing builders risk.

- California Location Check Form – This form gathers details about a location in California.

- Commercial Certificate of Insurance Request Form – This form can be sent to a client who needs a commercial certificate of insurance. It collects the information needed for a commercial insurance professional to create a certificate of insurance for their client.

- Commercial Insurance Coverage Declination Form – Use this form to obtain a signed declination statement from a client for many types of commercial insurance coverage.

- Commercial Property Profile (COPE) – Single Building Form – Use this form to gather construction, occupancy, protection and exposure (COPE) information about a single building.

- Confirmation of Completed Repairs – Use this form to receive confirmation of completed repairs after a claim.

- Contact Information Update Form – Send this form to a client to allow them to provide updates to their contact information (e.g. Phone numbers, email addresses and additional contacts).

- Customer Experience Feedback Form (NPS) – Use this form to gather the information needed to calculate a Net Promoter Score for your agency.

- General Claim Report Form – This form gathers information about a personal or commercial lines claim.

- Home Replacement Cost Appraisal Analysis Form -This form asks questions to gather construction characteristics from a client to conduct a replacement cost analysis on a home.

- Legal Entity Information Form – This form can be sent to a client who placed their home or other asset into an asset protection entity (e.g. LLC, Trust, etc…). It will gather information about that entity to share with an underwriter.

- Mortgage Closing Insurance Verification Request – Lender Form – This form can be sent to a lender/bank/mortgage broker to gather mortgagee name and address and loan number along with other details about the closing that may impact the insurance.

- Multi-Factor Authentication Attestation – Use this form to obtain a signed Multi-Factor Authentication Attestation.

- New Vehicle Information Dealer Form – Send this form to a dealer to collect information about a new vehicle your client is purchasing or leasing.

- New Vehicle Information Client Form – This form is for clients to complete when they are purchasing or leasing a new vehicle.

- New Vehicle Information Dealer/Seller Form – Send this form to a dealer or a seller who is not a dealership to collect information about a new vehicle your client is purchasing or leasing. This form is the latest version and has clarified questioning about how the car is registered.

- Older Structure Updates Form – Use this form to gather information about updates made to older structures.

- Personal Automobile Coverage Suspension Request Form – Send this form to a client if they wish to suspend coverages on a vehicle when it is not in use. They will be able to enter details so the agent can discuss this strategy further or make a policy change.

- Personal Automobile Glass Claim Request Form – Send this form to a client to obtain information about a new class claim so it can be submitted to the insurance company.

- Personal Automobile Insurance Claim Report Form – This form collects information about a new personal automobile insurance claim.

- Personal Cyber Insurance Coverage Request – PURE Insurance Company – Agencies can use this form to send to PURE Insurance clients who they wish to offer cyber insurance to. It will allow a client to select the coverage limit they want so the agent can add it to their insurance program.

- Personal Insurance Cancellation Request Form – This forms asks questions to assist with cancelling a personal lines policy and creating a lost policy release (LPR).

- Personal Insurance Claim Feedback Form – This form gathers feedback about a claims experience for a personal insurance policy.

- Personal Insurance Coverage Declination Form – Use this form to obtain a signed declination statement from a client for many types of personal insurance coverage.

- Personal Insurance Policy Changes for Multiple Policies Form – A client can select from several policy change types (ie. add a driver, add a car, remove a mortgage) and answer questions related to that policy change in this form.

- Personal Insurance Proposal – Single Carrier Form (Premium Form) – Agents complete this form to create a professional looking single carrier personal insurance proposal.

- Personal Insurance Proposal – Carrier Comparison Form (Premium Form)- Agents complete this form to create a professional looking personal insurance proposal that compares two carriers.

- Personal Insurance Renewal Checklist – Use this checklist to manage the renewal process for a personal lines client.

- Producer Issuance Form – Personal Lines – A producer should complete this form prior to issuing a new policy to ensure they have all the pertinent information needed to issue it accurately.

- Producer Quote Options Form – Personal Lines – A producer should complete this form to outline any changes they need made to a quote.

- Residential Fire Protection Evaluation – Department Form– Send this form to fire department personnel to obtain detailed information about the department, their response capability, and other important fire protection details. This is typically used for unprotected homes over five miles from the fire department.

- Statement of Diligent Effort – Florida Form – Agents complete this form to populate a Statement of Diligent Effort form for Florida excess and surplus lines placements.

- Statement of No Loss – Use this form to obtain a signed statement of no loss.

- Thank you note – Handwrytten.com– This form was built to streamline the process of writing thank you notes in conjunction with Handwrytten.com. If an integration is set up through Zapier, filling out this form will send a card through Handwrytten.com once it is submitted.

- Vacation Rental Home Supplemental Form – This form gathers additional details about a vacation rental property.

- Watercraft Severe Storm Statement Form – This form gathers information about a client’s plans for their watercraft in the event of a severe storm and obtains a signature.

Kurt Thoennessen, CAPI

Kurt Thoennessen, CAPI is the Founder of RiskRevu.com. He is also a Personal Risk Adviser for successful Individuals and Families.